Two siblings can have power of attorney if that is what the principal wants. This is known as a dual or joint power of attorney. These are often put in place by parents to ensure cooperation and fairness between children, but can lead to disputes when unanimous decisions cannot be reached.

And those disputes and complications can spiral out of control very fast. As a lawyer, I have seen families ripped apart after spending tens of thousands of dollars fighting over decisions relating to the financial affairs of their loved ones.

That’s why it’s really important to think through your power of attorney carefully before giving it to anyone.

Read on to learn all about:

- The parts that make up a power of attorney,

- The ways multiple siblings can be given power of attorney,

- The pros and cons of granting power of attorney to two siblings,

- More.

Please note: The information provided in this article is for general US legal system informational purposes only and is not legal advice. This article does not create an attorney-client relationship between the reader and the author, nor should it be relied upon as a substitute for legal advice regarding your specific situation.

In This Article

Breakdown: Power of Attorney

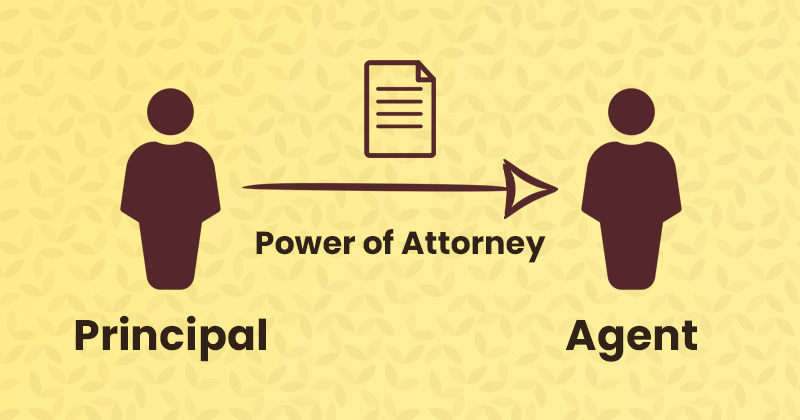

According to the American Bar Association, a power of attorney is a legal document that allows one person to appoint another person to handle their affairs on their behalf, while they are alive.

This is different to the executor of an estate, who manages a person’s financial affairs after their death.

The two persons involved in the power of attorney “relationship” are:

- The Principal: This is who the power of attorney is for. They are the person (such as an elderly parent) who creates the power of attorney and authorizes someone else to make certain health care or financial decisions on their behalf.

- The Agent/Attorney-in-fact: This is the person appointed by the Principal to act on their behalf. This can be a family member or members (such as multiple children), friend, lawyer, or anyone else the Principal trusts with this responsibility. The Agent has fiduciary obligations to the Principal, requiring them to exercise the power-of-attorney only in the best interests of the Principal.

Because of the massive amount of power the Principal gives, and the significant responsibilities the Agent takes on, most people only appoint a single Agent, being the person they trust most to act in their best interests.

This is even more important in the case of a durable power of attorney, that can still be used when the Principal loses capacity (i.e. no longer has the ability to make decisions for themselves, as determined by a licensed medical professional).

It is very common for a husband to appoint his wife as his Agent, and for her to do the same for him.

Despite this, in some cases a Principal will want to appoint more than one Agent.

Giving Two Siblings Power of Attorney

There are a number of ways for a Principal to give power of attorney to two brothers or sisters. I will expand on them below:

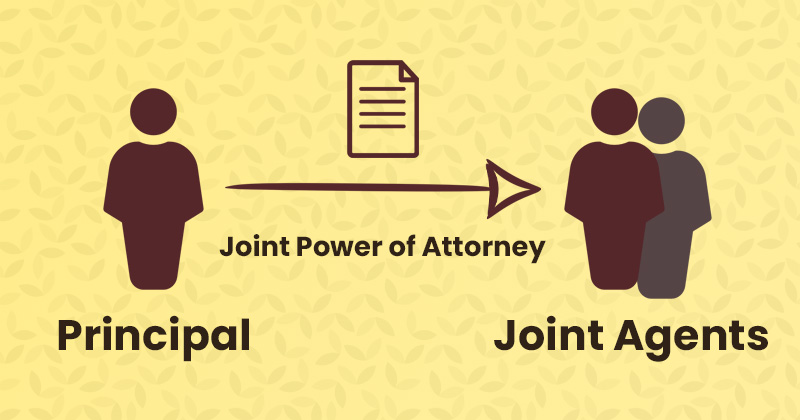

Joint Power of Attorney

A dual or joint power of attorney is a type of power of attorney that appoints two Agents to act on behalf of a Principal.

In other words, the Principal (e.g. a parent) grants authority to two individuals (e.g. their two children) to make decisions and take actions on their behalf in case one sibling is unavailable to perform their duties.

There are two broad types of joint power of attorney:

Joint Agents

Under this arrangement, both siblings would be required to make all decisions jointly. This means that both Agents’ signatures will be required for any transaction or decision.

Concurrent Agents

Under a concurrent Agent scheme, each sibling would have separate and independent powers.

They can act independently without seeking consent from the other Agent unless the power of attorney documentation, or law specific to your jurisdiction, states otherwise.

Successor/Alternative Agents and Rights of Consultation

Another option for granting power of attorney to two siblings is to appoint one as a “Primary” Agent and one as a “Successor” or backup Agent if the Primary Agent is unable to act.

This is a way that parents can get more than one child involved, without making things too messy.

In some jurisdictions, a Principal is also able to include a duty to consult in their power of attorney, requiring their Agent to discuss major decisions with other named people before making them.

Again, this means that multiple siblings can be involved in their parent’s care, minimizing discord and jealousy, while still keeping things relatively simple.

Regardless, of the path you are considering, before making any decisions on how to assign power of attorney to multiple siblings I strongly recommend:

- Discussing your wishes with your intended Agent(s),

- Consulting with a lawyer who practices in this area.

Pros and Cons of Giving Multiple Siblings Power of Attorney

The reason I have emphasized the importance of discussing your wishes with your intended Agent(s), and consulting with a lawyer, is that the legal area of powers of attorney is fraught.

There are a number of pros and cons associated with appointing more than one Agent.

Pros

- Convenience: Splitting up duties between two or more Agents can alleviate their individual burdens.

- Cooperation and Consideration: With more than one Agent, different perspectives come into play while making critical decisions, such as ones relating to personal or health care. This can minimize problems, risks and errors.

- Checks and Balances: There is less room for abuse of a Principal if more than one person is working together in their best interests, able to see and understand the actions of the other.

- Family Harmony: While it’s perhaps not the best reason for it, involving multiple siblings in decision-making can minimize tensions between family members.

Cons

- Disputes: Sometimes there is merit in having a single person to make the hard decisions. Two siblings making decisions on a Principal’s behalf, with completely opposite viewpoints, can lead to costly disputes and guardianship or probate proceedings. This is similar to disputes that arise when family members wish to override advance directives.

- Fraud/Financial Abuse: Multiple Agents may increase opportunities for fraud, in that more people will have access to the finances of the Principal.

- Delays: Multiple people involved in decision-making can slow the process down causing confusion.

- Complexity: It may be difficult to keep track of who is handling what responsibilities when many different hands are involved.

The Bottom Line

Two siblings can share a power of attorney through a dual or joint power of attorney.

In theory, this can ensure cooperation and fairness between children.

In reality, it is a situation that often leads to disputes and complications when unanimous decisions cannot be reached.

Regardless of what you decide, it is important to consult with a lawyer who practices in this area to ensure you are aware of the risks in your particular state, and get things done right.